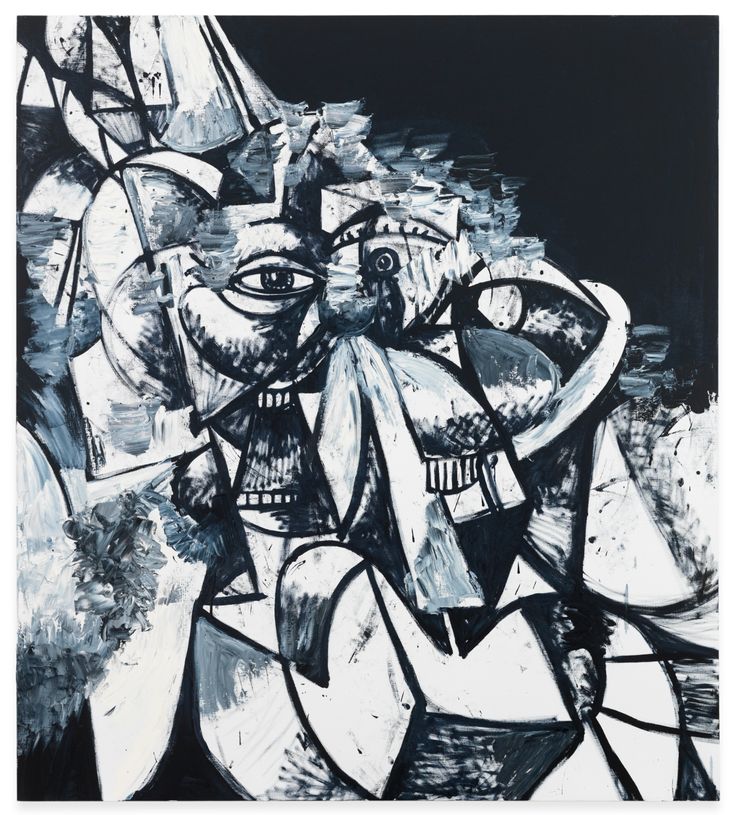

Art as an investment

Art funds or fractional ownership platforms offer exposure, but returns are unpredictable.

Art funds or fractional ownership platforms offer exposure, but returns are unpredictable.

Art investing blends passion, diversification, and prestige but is illiquid, subjective, and high-risk.

Value depends on scarcity, artist reputation, and trends with top names commanding premiums.

Auction houses and galleries dominate sales, but fees, authenticity, and condition are crucial.

Storage, insurance, and restoration costs add burdens, while forgery and market risks exist.

Tax advantages and portfolio diversification are possible, but art may underperform traditional assets.

Art as an investment may be high-risk, but the rewards can be extraordinary. My collection has grown in value, providing a hedge against inflation and a source of aesthetic pleasure.

Investing in art has brought me both joy and financial rewards. It's a unique blend of passion and potential that has diversified my portfolio and added cultural prestige.

Art funds offer a convenient way to invest in the art market. I appreciate the exposure without the burdens of physical ownership, allowing me to diversify my portfolio with potential for solid returns.

Reputation trends blue-chip names.

Art investing blends passion, diversification, and prestige but is illiquid, subjective, and high-risk.

Auction houses and galleries dominate sales, but fees, authenticity, and condition are crucial.

20717 International Blvd, Seattle, WA 98198, US

homedepot@gmail.com